TransUnion credit freeze

TransUnion credit freeze account holders will breeze through this step-by-step guide on how to freeze their credit at TransUnion. A TransUnion credit freeze is a tool that allows consumers to secure their credit reports and prevent unauthorized access. It’s a simple and effective way to protect against identity theft and other types of credit fraud. The cost of a TransUnion credit freeze is entirely free – US congress passed a law removing all charges for credit freezes.

Don’t have a TransUnion account yet? Follow this link to TransUnion to create the correct type of account so you can freeze and unfreeze your credit quickly.

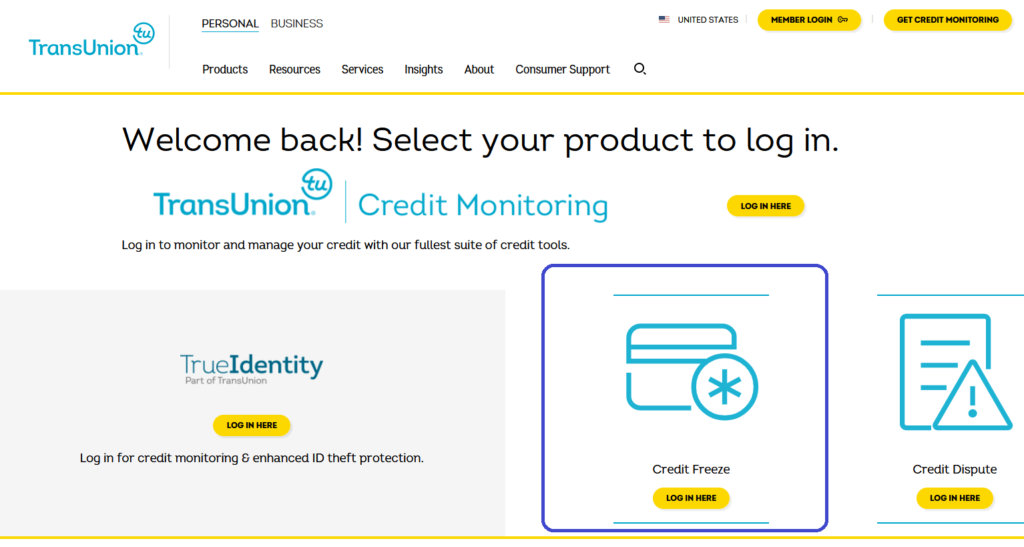

1. TransUnion Online Service Center Account Login

TransUnion has several different account types. Be sure to log in with the correct type, or else you will see an error page. On the bottom right of TransUnion’s consumer page, there is a yellow “log in here” button that will prompt for credentials for the correct account type. Click here for that page: https://www.transunion.com/customer-support/login. The login screen where you enter your username and password after clicking “log in here” looks like this screenshot.

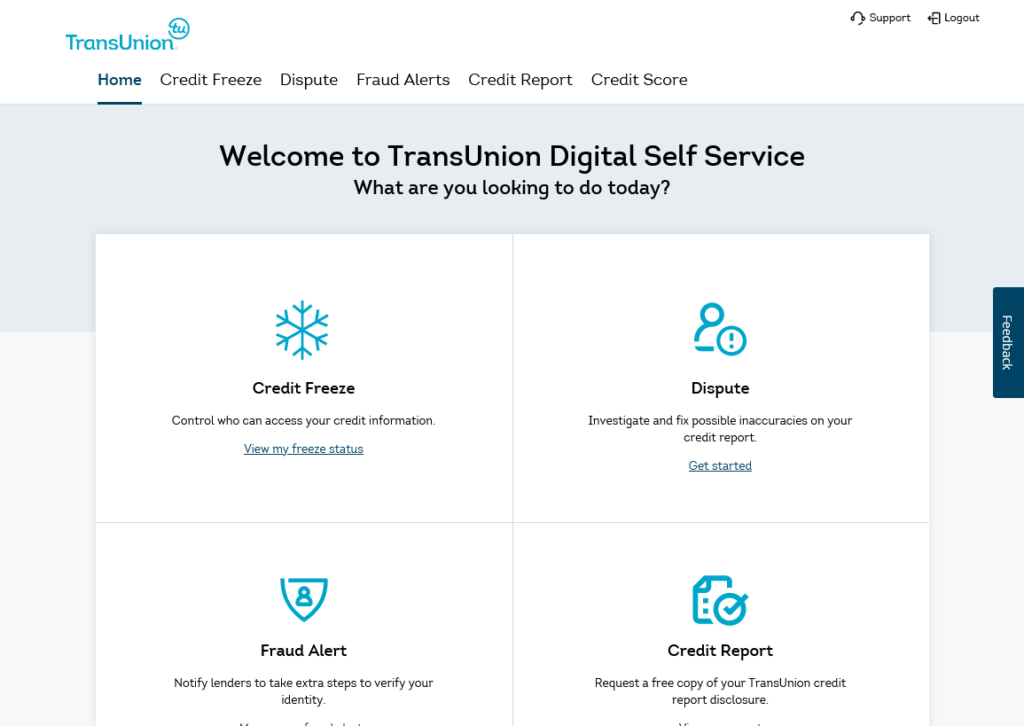

2. TransUnion Online Service Center account homescreen

After entering your login details, you will need to click through this simple continue message to enter your account dashboard. Once your account loads, the options are super simple. Click on the “View my freeze status” link on the top left-hand side.

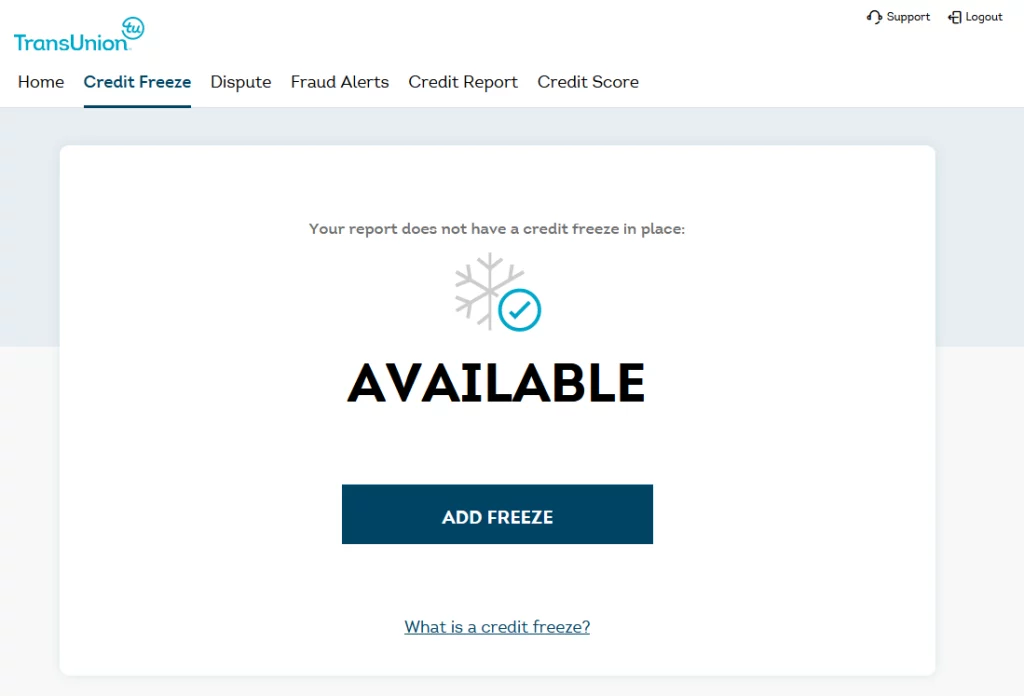

3. Add the TransUnion credit Freeze

TransUnion will determine that your file is currently thawed and show the page below with the single option to add a security freeze. Click “Add Freeze” to continue. How long does a TransUnion credit freeze last? Forever. There is no expiration date.

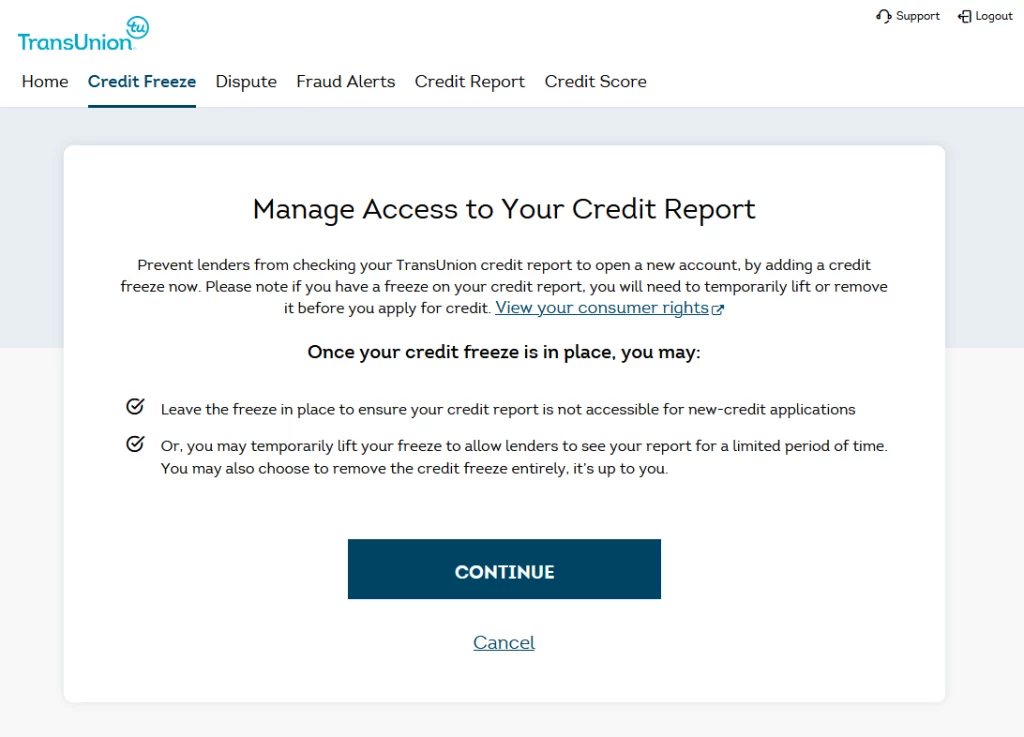

4. Disclosures about the Freeze

TransUnion used to require a PIN creation and confirmation at this step, but they did away with that in 2023. They replaced the PIN step with a continue step filled with disclosures about a credit freeze and how it works.

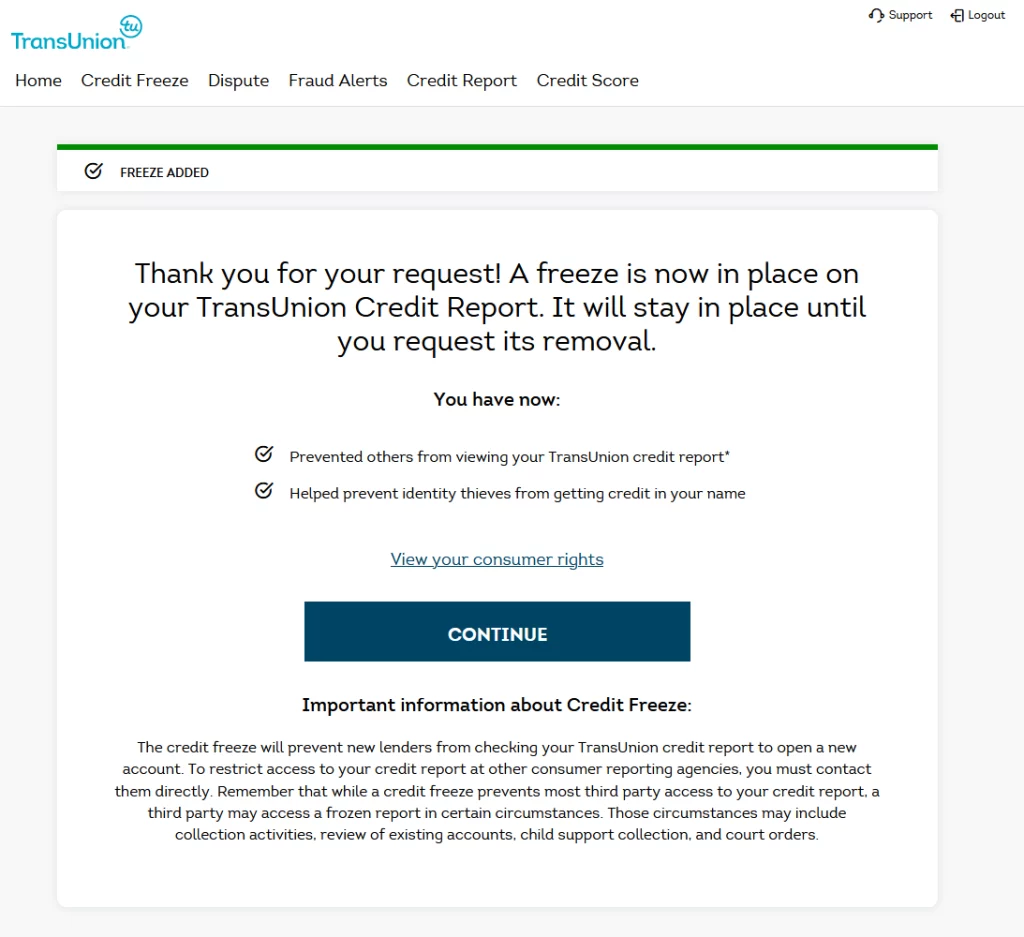

5. Confirmation

That’s it! You just froze your credit at TransUnion! You should receive a confirmation email in about twenty minutes. You should also see a huge “Frozen” status on the next page when you click the “continue” button.

Complete all credit bureau Freezes

With your TransUnion account, a TransUnion credit freeze is pretty straightforward. However, freezing your credit only at TransUnion will leave your credit files at the other bureaus available and vulnerable to identity theft. If you haven’t already done so, freeze your credit at Experian and Equifax to fully protect yourself. They are similar companies to TransUnion and can be considered alternatives to a TransUnion credit freeze.

Whenever you want to use your credit in the future, use our guides to unfreeze your credit. The best protection you can get is to temporarily lift your credit freeze when you apply for a new account.

Benefits of a TransUnion Credit Freeze

People may choose to freeze their credit with TransUnion for many reasons. A credit freeze is an effective way to prevent unauthorized access to your credit report. By freezing your credit, you control who can access your credit information and when. Here are some common reasons why you may want to consider freezing your credit with TransUnion:

- To prevent identity theft: Freezing your credit is one of the most effective ways to prevent identity theft. It stops thieves from opening new accounts in your name.

- To protect your personal information: A credit freeze helps to protect your sensitive personal information, including your Social Security number (SSN), date of birth, and current and previous addresses.

- To secure your financial information: Freezing your credit can also protect your financial information, such as your bank accounts, investment accounts, and credit card information.

- To avoid credit fraud: Freezing your credit can also prevent credit fraud, such as opening unauthorized credit accounts or using your personal information to obtain loans or credit cards.

In conclusion, freezing your credit with TransUnion can provide peace of mind and protection of your personal and financial information. It is a simple and effective tool to secure your credit report and prevent unauthorized access.